How To Start Private Limited Company And Its Impact

- - Category: Business Opportunities

- - 12 May, 2023

- - Views: 25

- Save

A private limited company is a type of business structure that is commonly used by small and medium-sized businesses.

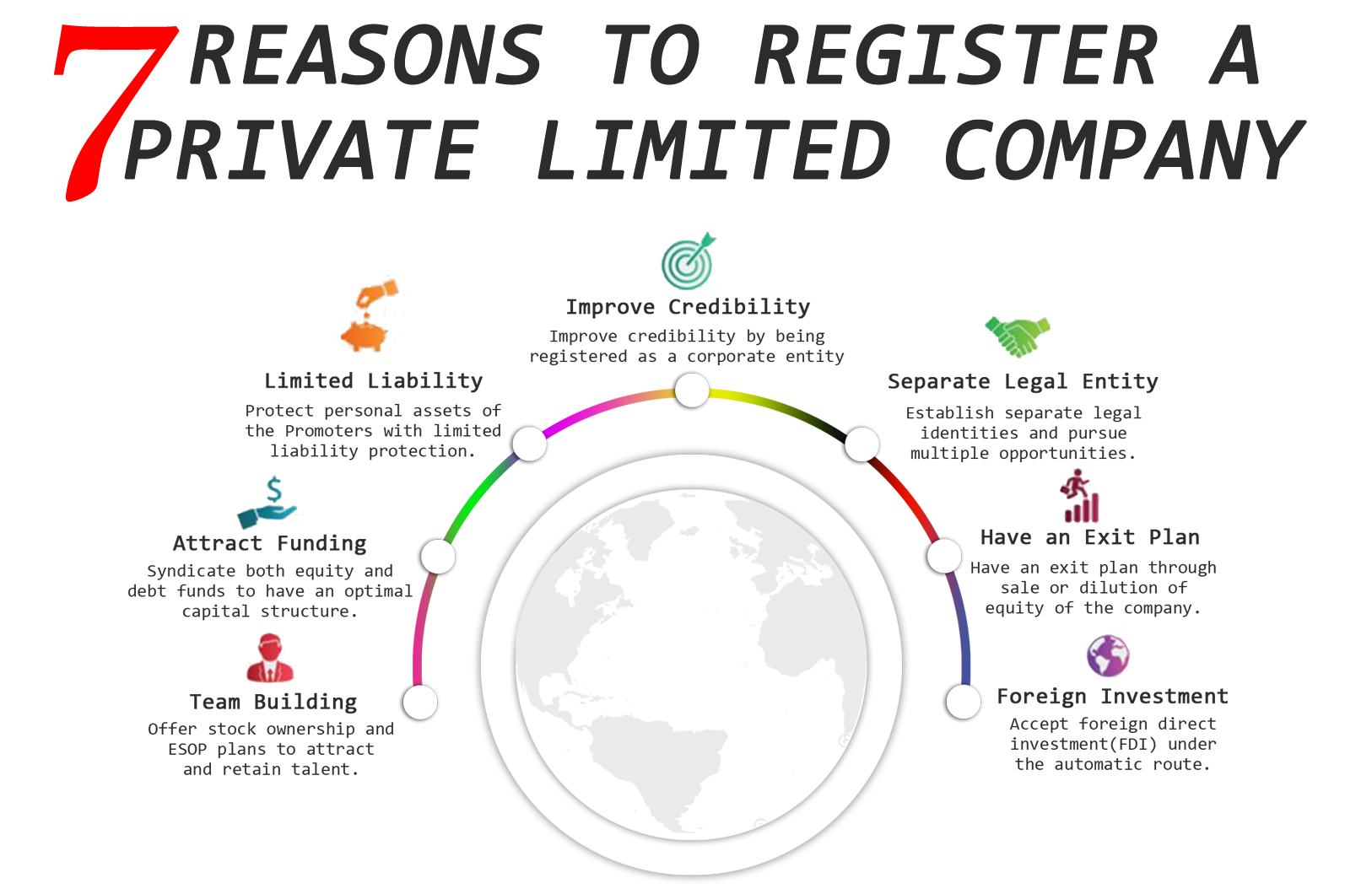

In a private limited company, the company is owned by shareholders, and the liability of the shareholders is limited to the amount of their investment in the company. This means that the personal assets of the shareholders are protected in the event that the company becomes insolvent or is unable to pay its debts.

A private limited company is a separate legal entity from its owners, which means that it can enter into contracts, sue or be sued, and own assets in its own name. This provides the owners with a level of protection and flexibility that is not available in other forms of business structures, such as sole proprietorships or partnerships.

Therefore below mentioned are the steps to register a private limited company,

- Choose and register a business name.

- Make your company name memorable and distinctive because it is the first impression your clients will have of your firm. Once you've decided on a company name, you must register it with your state's Registrar of Companies (ROC). The name should not be too similar to any existing business names or breach any existing trademarks.

- A private limited corporation is a separate legal entity that must have at least two directors and two shareholders.

- Get a Director Identification Number (DIN) as well as a Digital Signature Certificate (DSC)

- Every company director must have a unique DIN, which they can apply for online through the Ministry of Corporate Affairs website. In addition, the directors must have a DSC in order to sign electronic papers.

- Get a PAN and TAN for your organization.

- When forming the company, you must receive a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN). These are required for tax preparation and filing.

Create the Memorandum of Agreement (MOA) and Articles of Association (Articles of Association) (AOA)

Let's check private limited company might impact the financial market

Opportunities for Investing

A private limited company offers both individual and institutional investors investment opportunities, which is one of its key benefits. Investors can invest in the company and get a return on their money by purchasing shares of it. This money infusion may aid in the company's expansion and growth, which may benefit the financial market.

Growing Competition

Competition may also increase if a new private limited firm enters the financial sector. This can help consumers by lowering costs and raising the caliber of goods and services. Also, it might encourage current businesses to innovate and enhance their own products in order to stay competitive.

Creating Jobs

By generating jobs, establishing a private limited firm can also benefit the economy. The company may need to hire more employees as it develops and expands to keep up with demand. This could lower unemployment rates and improve the state of the economy as a whole.

Financial Transparency

Private limited companies must submit annual financial accounts to regulatory authorities. Transparency and accountability are offered, which aids in the development of trust among investors and stakeholders. This degree of financial reporting can also assist the financial sector by creating stability and minimizing the danger of fraud or corruption.

Getting Money

Moreover, private limited companies may have greater access to financial resources such as grants, loans, and venture capital. This might help the company's growth and bring up new opportunities. Moreover, funding possibilities for private limited companies may attract new capital to the banking industry.