Packaging Industry In India And Consumption

- - Category: Small Business

- - 02 Mar, 2023

- - Views: 995

- Save

In India packaging is growing at rapid pace. Uses various inputs from electricity, energy, paper, and more.

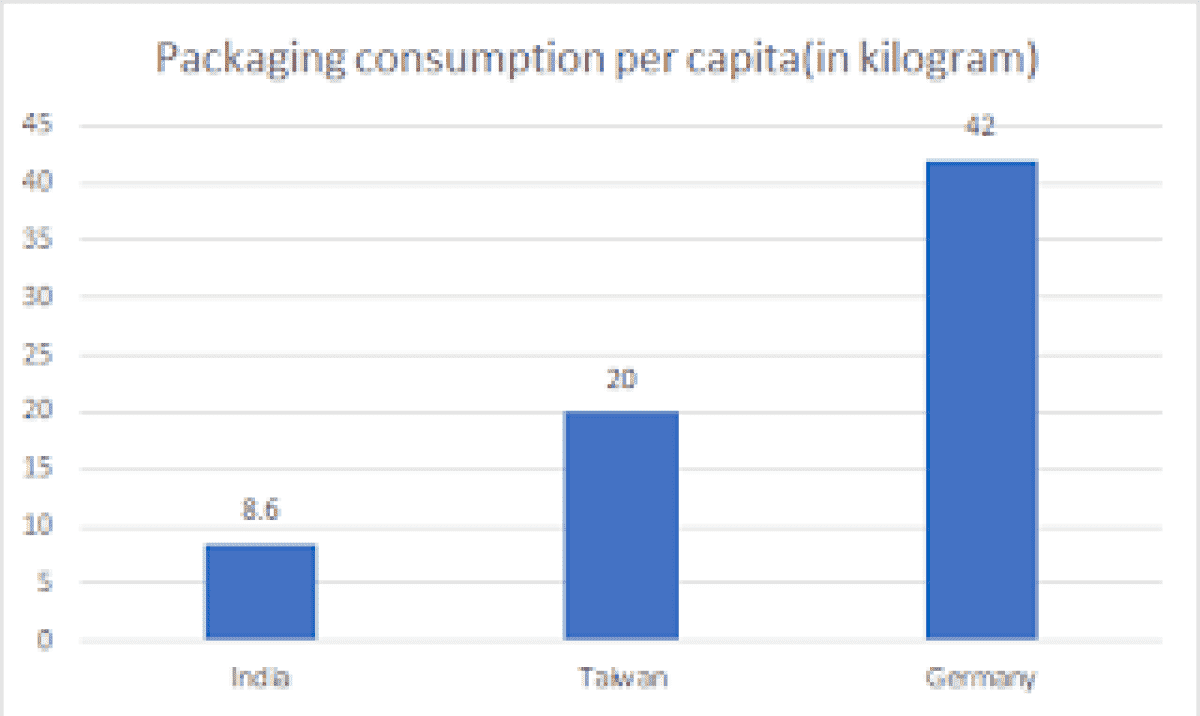

The packaging sector consumption in India can be ascertained from the diagram. It is per capita consumption of packaging in kilograms between India, Taiwan, and Germany. While the per capita consumption is 8.6 kg in India, is maximum for Germany is almost about 42 kg per capita, while for Taiwan it is 20 kg per capita. This shows that as per availability of packaging, it is very low market development for India, and maximum in Germany, pricing and promotions are as much in line with production quality levels, ease of supplier deliveries, and volumes.

Costs of operations, supplies, in packaging are almost 30-40% lower than in parts of Europe as ascertained from numerous studies and from the Packaging Industry Association of India. This introduces larger volumes, though the average consumption is as lower as an inverse relation. Factor mobility, factor costs, factor utility, and the utility of the input consumption are lower as compared to European nations.

A high-cost, but less technological wear-down is equally capable of meeting the demand for packaging in European nations, while low-cost, high wear-down in India and other LDCs is observing low volumes, and high demand growing by the day. Factor input effectiveness in utility is low in India than in Europe. This was evident from low volumes and exports some years ago.

As the years have passed, output volumes, quality, and exports of packaging products have increased. Packaging is expected to grow by 26% up to 2027 and already made a mark in overall industry valuation of $50.5bn in 2019. This rise in consumption is driving the rising Indian economy from strong favourable demographics, increasing disposable income levels, rising consumer awareness, and demand for processed food. The growth of individual end-user segments of food, beverages, FMCG, and pharmaceuticals is raising the demand for packaging solutions.

Government of India recognised the potential of this sector and released policies like the single-use plastic ban policy, profit-linked tax incentive for food packaging, and adoption of the National Packaging Initiative, to further incentivize innovation in this sector. A number of big producers posted significant profits in 5 years. Research stepped up with a rise in material technology, startups, and new sustainable packaging.

“In coming years, the Indian packaging industry will see substantial growth. The increasing awareness regarding clean water, safe food, and pharmaceuticals along with the adoption of next-gen digital technologies will aggressively penetrate and drive the Indian packaging industry” - Thomas Schneider, President of the World Packaging Organisation (WPO).

Energy consumption in packaging is higher in the past years. Also, the dependence of packaging is on upstream feedstock production like ethylene, propylene, styrene, etc. India currently imports nearly 1.7 MTPA of polyethylene (PE) in addition to utilizing around 73% of its domestic ethylene production towards PE and demand of which is mainly from packaging. This combined effect of energy and input consumption induces high production for meeting the growing demand in packaging and the future is just right for the sector when all inbuilt production is of a higher quality.

vividhpack.com

vividhpack.blogspot.com

ramanp31.livejournal.com