Unlock Financial Freedom: Your Guide To Obtaining A Loan Against Property With The Lowest Rates

Unlock financial freedom with LAP: Access funds for goals at lowest rates. Empower your finances.

In today’s fast-paced world, financial freedom is not just a luxury but a necessity. Whether it’s for fulfilling personal aspirations, funding education, or expanding your business, having access to quick and affordable financing can make all the difference. One such avenue that offers the flexibility and convenience you need is a loan against property (LAP). In this blog post, we’ll explore how you can leverage LAP to secure funds at the lowest interest rates, empowering you to achieve your financial goals with ease.

Understanding Loan Against Property

Before we dive into the specifics of obtaining a loan against property with the lowest rates, let’s first understand what exactly this financial instrument entails.

What is a Loan Against Property?

A loan against property, as the name suggests, is a secured loan that allows you to borrow funds by pledging your property as collateral. This property can be residential, commercial, or even a piece of land.

Key Features of LAP:

- Secured nature: Your property serves as collateral, reducing the risk for the lender.

- Higher loan amounts: Since the loan is backed by tangible assets, lenders are often willing to offer larger loan amounts compared to unsecured loans.

- Longer repayment tenure: LAP typically comes with longer repayment periods, making it easier to manage the EMIs.

- Flexible end-use: You can utilize the loan amount for various purposes, including business expansion, debt consolidation, education, medical expenses, etc.

Advantages of Loan Against Property

Opting for a loan against property offers several advantages over other forms of financing:

- Lower Interest Rates: LAP generally comes with lower interest rates compared to unsecured loans like personal loans or credit cards.

- Higher Loan Amounts: With LAP, you can access higher loan amounts based on the value of your property.

- Flexible Repayment Options: Lenders often provide flexible repayment options, allowing you to choose a tenure that suits your financial situation.

- Quick Processing: Since LAP is a secured loan, the approval process is usually faster than unsecured loans, offering quick access to funds.

Obtaining a Loan Against Property with the Lowest Rates

Now that we’ve established the benefits of LAP, let’s explore how you can secure a loan against property with the lowest interest rates:

1. Research and Compare Interest Rates:

- Start by researching various lenders and comparing their LAP interest rates. Look for institutions offering the most competitive rates.

- Utilize online comparison tools or visit the websites of different financial institutions to gather rate information.

2. Evaluate Loan-to-Value Ratio (LTV):

- LTV ratio determines the maximum loan amount you can borrow against your property’s value. A lower LTV ratio often results in lower interest rates.

- Opt for lenders offering higher LTV ratios while maintaining competitive interest rates.

3. Maintain a Good Credit Score:

- Your credit score plays a crucial role in determining the interest rate you’ll be offered. Aim to maintain a high credit score by paying bills on time and reducing outstanding debt.

- Lenders typically offer lower interest rates to borrowers with excellent credit scores.

4. Negotiate with Lenders:

- Don’t hesitate to negotiate with lenders to secure a better interest rate. If you have a strong credit profile or existing relationship with the lender, you may be able to negotiate for preferential rates.

5. Consider Loan Processing Fees:

- While focusing on interest rates, don’t overlook the impact of processing fees. Compare the total cost of borrowing, including processing fees, to make an informed decision.

Loan Against Property Interest Rates Comparison

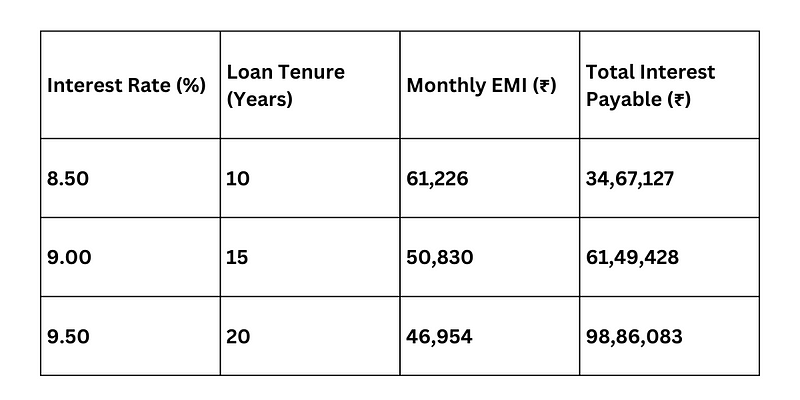

Let’s take a hypothetical scenario to illustrate how interest rates can impact your borrowing costs:

Suppose you need a loan of ₹50 lakh against your residential property valued at ₹1 crore. Here’s a comparison of monthly EMIs and total interest payments for different interest rates and tenures:

Conclusion

Obtaining a loan against property with the lowest rates is indeed achievable with careful research, comparison, and negotiation. By leveraging the equity in your property, you can access affordable financing tailored to your needs. Remember to assess your financial situation, evaluate various lenders, and consider all associated costs before making a decision. With the right approach, you can pave the way towards financial freedom and realize your dreams with ease.